AI Agents for Enhancing Actuarial Efficiency

1. Introduction

With the rapid rise of generative AI such as ChatGPT, AI Agents have become one of the most prominent technology trends. Unlike traditional programmed tools, AI Agents understand natural language, converse with users, interpret intent, and autonomously execute tasks. Because of these capabilities, big-tech firms are deploying AI Agents to drive operational efficiency and organizational redesign, and this momentum is spreading across industries. The insurance sector is no exception—insurers are actively exploring new ways of working and innovation opportunities enabled by AI Agents. How, then, are insurers actually using them?

2. AI Agents in the Insurance Industry

Insurers are introducing AI Agents to automate and optimize the value chain end to end. Key use cases include:

1) Claims Processing and Automation

AI Agents analyze diverse inputs—claim reports, images, medical records—and cross-check them against policy terms and regulations to determine eligibility, estimate payments, and flag potential fraud. This leads to faster turnaround, lower operating costs, and higher customer satisfaction.

2) Customer Engagement and Service

NLP-based conversational agents handle real-time inquiries, explain policy details, guide document submission, and send renewal reminders—reducing repetitive workload previously handled by human support staff and improving the customer experience.

3) Pricing

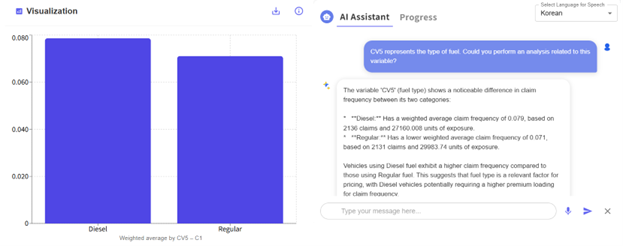

In the process of importing historical policy and claim data and performing pricing based on either traditional actuarial methods or machine learning and deep learning techniques, AI Agents support pricing by providing explanations of the pricing results. Without AI Agents, actuaries would need to manually analyze the relationships between risk variables and premiums and explain the results, a process that typically requires a significant amount of time.

When AI Agents assist in this analytical process, actuaries can more quickly perform relationship analyses among variables according to their needs, substantially reducing the time required for such tasks. As a result, actuaries are able to move away from repetitive and time-consuming work and focus more on efficient, value-adding, and core actuarial responsibilities.

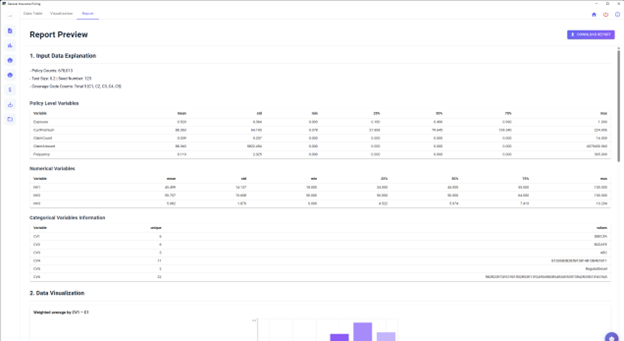

4) Reporting

Even when actuaries invest considerable time in conducting various analyses, a formal reporting process is essential for those results to be reflected in the company’s decision-making. For reporting purposes, key findings must be selected, processed, and summarized from the analytical outputs, and the content often needs to be restructured so that non-actuarial stakeholders can easily understand it.

By leveraging AI Agents, insurers can benefit not only from the automation of reports based on standardized templates, but also from improved management of historical analysis records and enhanced explanatory narratives. In an environment where regulations and internal controls regarding AI usage are becoming increasingly stringent, reporting plays a critical role not only in internal documentation but also in external compliance management.

3. AI with RNA

As a global actuarial consulting firm, RNA Analytics leverages a range of AI-Agent technologies to deliver tailored services. Among its solutions, the GIP (General Insurance Pricing) tool integrates with AI Agents to enhance:

- Automated Data Quality Validation: Detect anomalies in datasets and generate correction suggestions.

- Automated Modeling Execution: Train and compare multiple ML/DL models in parallel.

- Analytical Insights: Analyze DataFrames and outputs to support better decision-making.

- Report Generation: Automatically produce Word-format reports with key metrics and charts.

4. Conclusion

AI Agents can automate structured, repetitive actuarial tasks while supporting complex analysis and decision-making, improving both productivity and accuracy. Insurers must redefine how people and AI cooperate. RNA’s growing suite of AI tools represents a first step toward practical digital transformation in actuarial functions. Ultimately, AI Agents will not replace actuaries; they will serve as AI co-workers, expanding actuarial capabilities and setting a new standard for the insurance industry.