Enhancing Data Preprocessing with AI

1. Introduction

In the insurance industry, professionals—including actuaries—process raw data to derive a wide range of analytical results that inform key business decisions. Consequently, many organizations are actively studying ways to enhance pricing models through AI technologies such as Machine Learning (ML) and Deep Learning (DL). However, in practice, the stage that consumes the most time is often not advanced modeling itself, but data preprocessing. Data preprocessing is the process of refining and organizing raw data to enable effective analysis and modeling tailored to the user’s intended purpose.

2. What is Data Preprocessing

At its simplest, preprocessing can be understood as identifying and correcting missing or incorrectly entered values in a dataset. However, this is only one sub-process within the data preprocessing specifically, data cleaning.

According to Han, Kamber & Pei (2012, 3rd Ed.), Data Mining: Concepts and Techniques, data preprocessing is defined as a standard framework that includes Cleaning, Integration, Reduction, Transformation, and Discretization. These stages go beyond mere error correction; they serve as the essential foundation for ensuring data quality and consistency, thereby preventing distortions when model training.

3. Why It Is Important

Data preprocessing is a crucial phase that has the greatest impact on the quality and reliability of analysis and modeling outcomes. Even the most sophisticated methodologies cannot produce meaningful insights if the underlying data are incomplete or biased. Following a structured preprocessing framework ensures that analysis and modeling are based on accurate and representative data. In practice, much of the preprocessing work involves repetitive, routine tasks that consume substantial time from junior staff. When those handling the data lack sufficient domain knowledge, analytical results may fail to meet expectations.

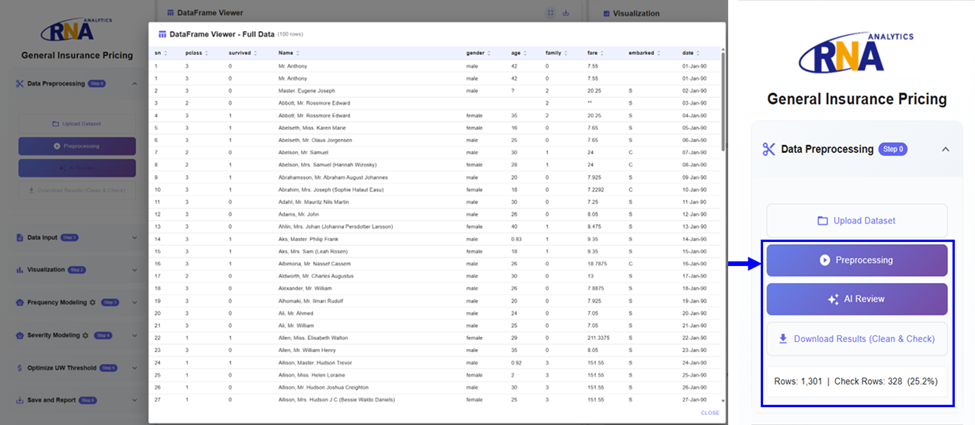

4. How It Will Collaborate with AI

Compared with the modeling stage (ML and DL), research and case studies applying AI to enhance data preprocessing remain relatively limited, yet reducing the time and cost of preprocessing is a shared goal across industries. Accordingly, AI is increasingly being used to extract information automatically from documents and images through OCR and reflect it directly in data frames, as well as to analyze column meanings, detect inconsistencies, and identify outliers using AI assistants. The advancement of AI-driven preprocessing technologies will be an area of growing importance in the future.

5. Conclusion

Data preprocessing is especially critical in insurance companies, which handle vast amounts of information. Nevertheless, the resources devoted to this area have not matched its importance. By combining programming with AI-integrated preprocessing workflows, junior staff can reduce repetitive manual tasks and focus on higher-value analytical work.

Going forward, the insurance industry must embrace digital transformation by combining AI technologies with data preprocessing to achieve fundamental improvements in efficiency and data quality.